What could the Good Brands Index do for you?

The Good Brands Index helps brands in the financial services industry to understand how consumers define a “good brand,” judge one brand versus another, and what matters most when making financial decisions.

How does it work?

The Goods Brands Index measures how emotional attributes present in moments of decision making create advantages and vulnerabilities for brands. The study:

- Allows you to rank and evaluate your brand against competitors and develop a marketing strategy based on what matters most to your target audience

- Can pinpoint exactly what you’re doing that resonates with consumers and what doesn’t

- Can shape not only how you communicate, but how you operate in order to really connect to the people you serve

- Gives understanding of how “good” is defined at key moments in your customers’ financial journeys, enabling you to move them to act

An example: Preston Spire was tasked with helping a large banking institution find places to grow in a highly competitive market where advertising spend was at an all-time high. A category where to breakthrough you need not only a successful communication plan, but an effective and hardworking business plan. They enlisted us to execute our Good Brands Index study.

Results

- Exposed critical operational issues that, if unaddressed, would lead to negative customer experience, further attrition and stagnant new customer acquisition

- Found opportunities to optimize communication vehicles to increase ROI

- Identified which competitors would be most vulnerable to losing market share and, more importantly, those not to target with our efforts

- Determined what our client’s greatest competitive strength is and how to leverage it

- Discovered what’s needed to build trust, a must-have to increase the volume of assets under management in a highly fragmented and competitive industry

Key Findings

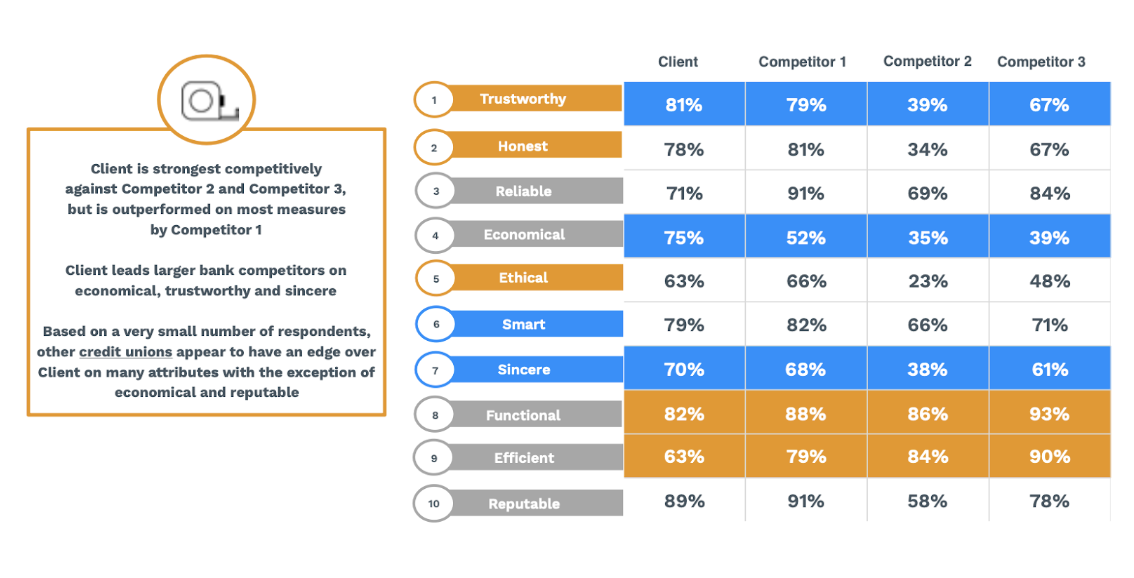

One example of our key findings was how our Client performed against its competitors when consumers were asked to rate each brand on emotional and rational attributes.

This is a summary of how the client performed against its competitors when consumers were asked to rate each brand on emotional and rational attributes.

Our Client’s most compelling competitive strength was being economical, which is very rational. Emotional strengths were trustworthy and sincerity. Their greatest weakness was efficiency, with functional being a distant second.

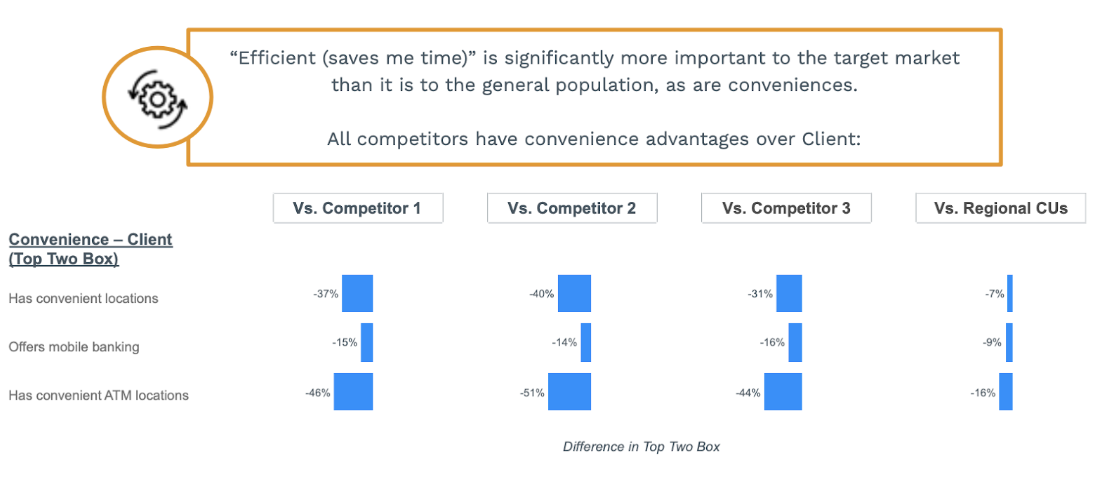

This is an example of how bringing findings together can underscore areas of need. In this case, consumers were asked how companies rated the convenience attribute. Our client scored significantly lower than its competitors, likely contributing to its weakness in efficiency.

What the Good Brands Index could mean for your financial services brand

We hope you see the impact using the Good Brands Index as a tool could have on your brand and the approach you choose to take for the future. Consider how your business might change if you knew what consumers perceived as your most compelling competitive strength. Or the investment and resources saved by understanding which competitors you must steal from, defend against, and how to do it.

The Good Brands Index is something no other agency can provide you today, to help you better understand the consumer mindset and decision making based on emotion. If you are interested in this work and what it can do for your brand, then the first step is to request a Good Brand Audit.